$516.00

The Alaska Division of Motor Vehicles (DMV) requires that alternative vehicles, such as snowmobiles, custom-built cars, and all-terrain vehicles (ATVs), be registered with the state.

The DMV issues license plates for commercial trailers.

A municipality that chooses

26 to change the tax imposed under (b) or (l) of this section or establishes a tax for

27 permanently registered motor vehicles or trailers shall file a written notice of the

28 change with the department by January 1 of the year preceding the year in which the

29 change in tax is to take effect. requested service. outsideofAK] [Military] [Forms] [DrivingRecords] [FeesandTaxes] [PaymentOptions] [ContactUs] [PrivacyPolicy], CONTACT

A lien release, if there is a lien against the car. 9. Therefore, the NATM (National Associated of Trailer Manufacturers) was created to ensure that participating manufacturers have the processes in place to build trailers in accordance with federal regulations and to verify that the trailers comply with all safety regulations. 09 * Sec.

Every new trailer will have a manufacturer's warranty. that processing fees vary depending upon the

AS 28.10.431(j) is amended to read:

20 (j) A municipality that imposes a motor vehicle registration tax as described

21 under (a) of this section may also, by passage of an appropriate ordinance, increase

22 the scheduled amount of tax described under (b) or (l) of this section, establish a tax

23 for a motor vehicle that is permanently registered under AS 28.10.155, or

24 establish a tax for a trailer that is permanently registered under AS 28.10.421(j)

25 [BY PASSAGE OF AN APPROPRIATE ORDINANCE]. newer vehicles principally used or

The department may

31 charge a municipality a one-time fee to cover the cost to the department of. 2. are automatically registered as

$30.00 Trailers

State of Alaska to process DMV

AS 28.10.431(b) is amended to read:

16 (b) The biennial tax is levied upon motor vehicles subject to the registration

17 fee under AS 28.10.411 and 28.10.421 and is based upon the age of vehicles as

18 determined by model year in the first year of the biennial period, according to the

19 following schedule:

20 Tax According to Age of

21 Vehicle

22 Since Model Year:

23 8th

24 1st 2nd 3rd 4th 5th 6th 7th or over

25 Motor Vehicle

26 (1) motorcycle $ 17 $ 15 $ 13 $ 10 $ 7 $ 5 $ 4 $ 4

27 (2) vehicles specified 21 99 77 55 39 28 19 16

28 in AS 28.10.421(b)(1)

29 (3) vehicles specified 121 99 77 55 39 28 19 16

30 in AS 28.10.421(b)(3)

31 (4) vehicles specified, 01 in AS 28.10.421(c)(1)-(4)

02 5,000 pounds or less 121 99 77 55 39 28 19 16

03 5,001-12,000 pounds 198 154 121 99 77 55 33 22

04 12,001-18,000 pounds 447 392 348 304 260 227 205 194

05 18,001 pounds or over 546 469 403 348 304 260 216 194

06 (5) vehicles specified 198 154 121 99 77 55 33 22

07 in AS 28.10.421(b)(4)

08 (6) vehicles specified 17 15 13 10 7 5 4 4

09 in AS 28.10.421(j)

10 [AS 28.10.421(b)(6)]

11 (7) vehicles specified 121 99 77 55 39 28 19 16

12 in AS 28.10.421(d)(8)

13 (8) vehicles specified 121 99 77 55 39 28 19 16

14 in AS 28.10.421(b)(2)

15 (9) vehicles eligible 88

16 for dealer

17 plates under

18 AS 28.10.421(d)(9). Registration requirements for other vehicle types are listed below. [Lending/FinancialInstitutions] [Dealerships] [AlaskanCustomersinAK] [AlaskanCust. You will need: For more information, see our page Motorcycle Registration in Alaska. If you'd like to get the additional items you've selected to qualify for this offer. on the Application for Title and Registration (Form 812), is considered to be commercial. Snow machines do not have to be titled but must be registered. (Trucks and vans

Get free quotes from the nation's biggest auto insurance providers. (opens in new window), Follow White Spruce Trailer Sales on Twitter! You must also have a permit or license to operate a motor-driven cycle: In Alaska, registering a custom-built car requires a different process to registering a regular vehicle. Subscribe to stay in the loop & on the road!

The motor vehicle registration tax for a permanently

03 registered trailer is the rate established for permanent trailer registration under

04 AS 28.10.431(j). in a business name or over 10,000

Submit the certificate of title for the chassis of the vehicle. lbs. Refresh your browser window to try again. Do you offer a warranty on your trailers?

Add to cart to save with this special offer.

If the person permanently registers the trailer, no additional registration

30 fees are required if the same person who initially registered the trailer continues to

31 own the trailer. Alaska's varying landscape of forests, mountains, tundra, and snow and ice fields promote alternative forms of transportation. The motor vehicle registration tax for a permanently registered

07 vehicle is the rate established for permanent motor vehicle registration under

08 AS 28.10.431(j). Reference the vin sticker on your trailer for the Gross Vehicle Weight Rating (GVWR). Payload Capacity = Gross Vehicle Weight Rating - Trailer Empty Weight. Questions? Depending on the season, in some areas residents rely on snowmobiles more than cars. emissions inspection - 1968 and

Certified by the

For commercial vehicles, see

22 * Sec. 14 * Sec. A permanent registration may not be renewed.

02 * Sec. That fee shall be collected biennially. 04 (b) The fees for permanent registration must equal the fees that would be

05 applicable if the motor vehicle were registered under AS 28.10.108, plus a permanent

06 registration fee of $25. Compare over 50 top car insurance quotes and save.

0 - 5,000 pounds

To register, submit the following to any DMV office: Dealerships are required by law to collect, at the point of sale, a completed Application for Title and Registration (Form 812) and all applicable fees.

If you have traveled outside of the state, we will find the closest repair shop to help you with your repairs and process the warranty paperwork on your behalf. Non-Commercial, $100 Passenger Vehicles

Permanent motor vehicle registration. Join 1,972,984 Americans who searched for Car Insurance Rates: SUMMARY: How to Register Special Vehicle Types in Alaska. We are proud to offer a military discount of $50/trailer and 5% off all parts and service to active duty, retired and reserve military members and their spouses. & Motorhomes (For LEASED vehicles,

Like White Spruce Trailer Sales on Facebook! Looking for Other Vehicle Registrations in another state? All of our 3 locations are outside of any sales tax areas. This Act takes effect January 1, 2014. No. Each state has its own regulations as to whether it is required or not. (opens in new window), Check out the White Spruce Trailer Sales YouTube channel! Anchorage and 1975 and newer

Please

White Spruce Trailer's top concern is providing a safe trailer to our customers so while it is not necessary we have made it a requirement for all tandem axle trailers we sell to be equipped with brakes on all wheels. Please contact a sales representative to go over what your needs are. Some will process your registration at the dealership. If you Buy It Now, you'll only be purchasing this item. All documents on

During the original registration process, the DMV will send you decals that will serve as the vehicle's permanent numbers. Something went wrong. On receiving the

02 proper application and fees, the department shall issue to the registered owner

03 registration plates, tabs, and a permanent registration form. 8.

You will need to visit your local Alaska DMV office and: This form is provided by your state's agency/department. see

registration fees. Depending on the duration of the registration, include $10 for 2 years, $20 for 4 years, or $30 for 6 years. We accept cash, credit, debit, cashier's checks and business checks (upon approval and proper identifcation). the I/M program. AS 28.10.411(f) is amended to read:

15 (f) A resident 65 years of age or older on January 1 of the year the vehicle is

16 registered or a resident with a disability that limits or impairs the ability to walk and

17 who provides proof of that disability as provided in 23 C.F.R. Text a bill number (ex: HB1) to 559-245-2529 to enroll in text alerts. Fees and taxes may vary depending on your vehicle and which county you reside in.

AS 28.10.423 is amended by adding a new subsection to read:

11 (b) In addition to the permanent registration fee established in AS 28.10.155, a

12 $2 fee is imposed on the owner of each permanently registered motor vehicle required

13 to be inspected under an emission control program established in AS 46.14.400 or

14 46.14.510. titles and registrations. contact us for moreinformation. US - Call: (907) 345-2886 - Email: info@alaskaautotitles.com

How do I get my title for the trailer I purchased?

The item you've selected was not added to your cart. When completing this form, be sure to record the trailer's unladen weight. (One time fee)

SMS Bill Tracking! The DMV defines a snow machine as any vehicle that's designed to travel over ice and snow using mechanical propulsion in conjunction with skis, belts, cleats, or low-pressure tires.

If unknown, provide an estimated guess. 5,001 - 12,000 pounds

All Rights Reserved. A new owner of a trailer previously registered under this subsection, 01 shall register and pay the biennial registration fee or the permanent registration fee as

02 provided in this subsection. The current registration, if transferring from outside of AK. White Spruce Trailers will collect all the information necessary to process the title, registration, and plates on your behalf. Others will ship your information to the DMV. AS 28.10.421 is amended by adding a new subsection to read:

23 (j) When a person registers a trailer not used or maintained for the

24 transportation of persons or property for hire or for other commercial use, including a

25 boat trailer, baggage trailer, box trailer, utility trailer, house trailer, travel trailer, or

26 trailer rented or offered for rent, the person may choose to pay a biennial registration

27 fee of $30 or to register the trailer permanently. vehicles), $180.00

What does the NATM sticker on your trailers mean? Vehicles that travel exclusively on private property are exempt from the registration requirement.

1235.2 is entitled to an

18 exemption from the registration fee required under this section for one vehicle subject

19 to registration under AS 28.10.421(b)(1), (2), or (5), or (j) [(6)]. If a municipality has not established a tax for a permanently

05 registered trailer, the biennial rate established in AS 28.10.431(b) or (j), if any, is

06 levied upon the trailer and is payable only once at the time a trailer is permanently

07 registered. is collected to help defray the

Provide proof you own all major parts of the vehicle (such as bills of sales, receipts, and invoices). * Please note

this site are in Adobe PDF Format and require Adobe

If a municipality has not established a tax for a permanently

09 registered motor vehicle, the biennial rate established in AS 28.10.431(b) or (j), if any,

10 is levied upon the vehicle and is payable only once at the time a motor vehicle is

11 permanently registered. (opens in new window). 00 CS FOR HOUSE BILL NO. operated in the Fairbanks North Star

You must affix the decals above the footrests and below the seat, making sure neither decal covers the serial number or can be obstructed by a rider's or passenger's legs. $100

MISCELLANEOUS FEES. 1983 - Previous Year Legislative Resolves. 03 * Sec. Yes. Borough (excluding the two most

vehicles principally used or

an

The requirements for different vehicle types vary, and some are registered in the same way as regular cars and trucks. If you purchase a used ATV or snow machine from someone other than a dealer, you will need to submit to the DMV: The DMV deems a noncommercial trailer to be any trailer not titled or registered with a business, unless you, the owner, mark otherwise on the Application for Title and Registration (Form 812). REGISTRATION FEES

Please select one of the below to continue: Email this form to yourself and complete it on your computer.

01 implementing a change under this subsection. All commercial-trailer owners are required to pay a one-time $25 permanent registration fee. 15 * Sec. AS 28.10.421(b)(6) is repealed. $60.00 Motorcycles

Either a warranty card or a purchase order from the dealer. $300.00 Tour Buses

Unlike the auto industry, trailer manufacturing DOES NOT have standard regulations. Trucks & Cargo Vans under 10,000

AS 28.10 is amended by adding a new section to read:

10 Sec. The

14 permanent registration expires when the owner transfers or assigns the owner's title or, 01 interest in the vehicle. Copyright 1995-2022 eBay Inc. All Rights Reserved. Have your vehicle inspected (if you haven't already had it inspected by a law enforcement officer). 12,001 - 18,000 pounds

State of Alaska Department

commercial vehicle information. Please check your inbox (including spam box). Try our help wizard or call 907-465-4648. REGISTRATION FEES. Copyright 2022 Alaska Legislature, All Rights Reserved. 5. (opens in new window), Follow White Spruce Trailer Sales on Instagram! commercial vehicles.)

operated in the Municipality of

How to Register Custom-Built Vehicles in Alaska. The state fee for this option is $25.

Must be completed by whoever built the vehicle. All snow machine registrations periods are valid for a minimum of 2 years. Any trailer that is leased, registered to a business, or whose owner marks "yes" to the question "Is vehicle used commercially?" 3. Seller assumes all responsibility for this listing. I don't see the trailer I want in your inventory. You must register a motor-driven cycle with the Alaska DMV. AS 28.10.108(a) is amended to read:

06 (a) Except for a vehicle registered under AS 28.10.152 or 28.10.155, a vehicle

07 required to be registered under this chapter shall be registered under the procedures set

08 out in this section. If a problem arises, White Spruce Trailers will perform the repair and even complete any paperwork necessary to process the warranty. 3408 Arctic Boulevard, Anchorage, Alaska 99503

Payment for the $60 registration fee and any other, If you are 14 to 15 years old, you need a, If you are 16 years old or older, you can operate a motor-driven cycle with a regular Alaska. 19 * Sec. While not all manufacturers are a part of this program, White Spruce is dedicated to providing the highest quality trailers, therefore, we only supply trailers from manufacturer's that are part of the Compliance Verification Program of NATM.

Except as provided in AS 28.10.423(b), the owner of a

12 permanently registered motor vehicle is not required to pay other registration fees or

13 taxes under this chapter. Antique, Vintage & Historic Motorcycle Parts, - eBay Money Back Guarantee - opens in a new window or tab, - for PayPal Credit, opens in a new window or tab, Learn more about earning points with eBay Mastercard, - eBay Return policy - opens in a new tab or window, - eBay Money Back Guarantee - opens in a new tab or window. View cart for details. To

Commercial (Including all LEASED

$662.00 18,001 and over

If the person pays the registration tax as required by this subsection and

08 AS 28.10.431, no additional registration taxes are required if the same person who

09 initially registered the trailer continues to own the trailer. 19(TRA)

01 "An Act relating to permanent motor vehicle registration; relating to the registration fee

02 for noncommercial trailers and to the motor vehicle tax for trailers; and providing for

03 an effective date." $268.00

How do I determine the payload capacity of my trailer? For more information about registering your RV in Alaska, visit our Register Car in Alaska page. You will receive an enrollment confirmation and instructions on how to stop receiving the alerts.

If you reside in an eligible city in Alaska (see the current list from State of Alaska DMV), you can get a permanent registration on any trailer. 6.

$20.00 Trailers

4. For vehicles which are subject to

Alaska Trailer License Plate / Alaskan Registration Collectible Original. If the person permanently registers the

28 trailer, the person shall pay the biennial registration fee plus a permanent registration

29 fee of $25. An exemption may

20 not be granted except upon written application for the exemption on a form prescribed

21 by the department.

The Alaska DMV defines motor-driven cycles as vehicles such as scooters and mopeds with a displacement of 50 cc or less. 04 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF ALASKA:

05 * Section 1. By seeing the NATM sticker on a trailer, it will signify to you that the trailer manufacturing process has been verified to comply with federal safety regulations. A municipality may not change the amount of the tax

30 imposed under this section more than once every two years. If a credit or debit card is being used and the amount of the charge exceeds $2,000, a card fee of 3% will be imposed.

The DMV issues license plates for commercial trailers.

A municipality that chooses

26 to change the tax imposed under (b) or (l) of this section or establishes a tax for

27 permanently registered motor vehicles or trailers shall file a written notice of the

28 change with the department by January 1 of the year preceding the year in which the

29 change in tax is to take effect. requested service. outsideofAK] [Military] [Forms] [DrivingRecords] [FeesandTaxes] [PaymentOptions] [ContactUs] [PrivacyPolicy], CONTACT

A lien release, if there is a lien against the car. 9. Therefore, the NATM (National Associated of Trailer Manufacturers) was created to ensure that participating manufacturers have the processes in place to build trailers in accordance with federal regulations and to verify that the trailers comply with all safety regulations. 09 * Sec.

Every new trailer will have a manufacturer's warranty. that processing fees vary depending upon the

AS 28.10.431(j) is amended to read:

20 (j) A municipality that imposes a motor vehicle registration tax as described

21 under (a) of this section may also, by passage of an appropriate ordinance, increase

22 the scheduled amount of tax described under (b) or (l) of this section, establish a tax

23 for a motor vehicle that is permanently registered under AS 28.10.155, or

24 establish a tax for a trailer that is permanently registered under AS 28.10.421(j)

25 [BY PASSAGE OF AN APPROPRIATE ORDINANCE]. newer vehicles principally used or

The department may

31 charge a municipality a one-time fee to cover the cost to the department of. 2. are automatically registered as

$30.00 Trailers

State of Alaska to process DMV

AS 28.10.431(b) is amended to read:

16 (b) The biennial tax is levied upon motor vehicles subject to the registration

17 fee under AS 28.10.411 and 28.10.421 and is based upon the age of vehicles as

18 determined by model year in the first year of the biennial period, according to the

19 following schedule:

20 Tax According to Age of

21 Vehicle

22 Since Model Year:

23 8th

24 1st 2nd 3rd 4th 5th 6th 7th or over

25 Motor Vehicle

26 (1) motorcycle $ 17 $ 15 $ 13 $ 10 $ 7 $ 5 $ 4 $ 4

27 (2) vehicles specified 21 99 77 55 39 28 19 16

28 in AS 28.10.421(b)(1)

29 (3) vehicles specified 121 99 77 55 39 28 19 16

30 in AS 28.10.421(b)(3)

31 (4) vehicles specified, 01 in AS 28.10.421(c)(1)-(4)

02 5,000 pounds or less 121 99 77 55 39 28 19 16

03 5,001-12,000 pounds 198 154 121 99 77 55 33 22

04 12,001-18,000 pounds 447 392 348 304 260 227 205 194

05 18,001 pounds or over 546 469 403 348 304 260 216 194

06 (5) vehicles specified 198 154 121 99 77 55 33 22

07 in AS 28.10.421(b)(4)

08 (6) vehicles specified 17 15 13 10 7 5 4 4

09 in AS 28.10.421(j)

10 [AS 28.10.421(b)(6)]

11 (7) vehicles specified 121 99 77 55 39 28 19 16

12 in AS 28.10.421(d)(8)

13 (8) vehicles specified 121 99 77 55 39 28 19 16

14 in AS 28.10.421(b)(2)

15 (9) vehicles eligible 88

16 for dealer

17 plates under

18 AS 28.10.421(d)(9). Registration requirements for other vehicle types are listed below. [Lending/FinancialInstitutions] [Dealerships] [AlaskanCustomersinAK] [AlaskanCust. You will need: For more information, see our page Motorcycle Registration in Alaska. If you'd like to get the additional items you've selected to qualify for this offer. on the Application for Title and Registration (Form 812), is considered to be commercial. Snow machines do not have to be titled but must be registered. (Trucks and vans

The DMV issues license plates for commercial trailers.

A municipality that chooses

26 to change the tax imposed under (b) or (l) of this section or establishes a tax for

27 permanently registered motor vehicles or trailers shall file a written notice of the

28 change with the department by January 1 of the year preceding the year in which the

29 change in tax is to take effect. requested service. outsideofAK] [Military] [Forms] [DrivingRecords] [FeesandTaxes] [PaymentOptions] [ContactUs] [PrivacyPolicy], CONTACT

A lien release, if there is a lien against the car. 9. Therefore, the NATM (National Associated of Trailer Manufacturers) was created to ensure that participating manufacturers have the processes in place to build trailers in accordance with federal regulations and to verify that the trailers comply with all safety regulations. 09 * Sec.

Every new trailer will have a manufacturer's warranty. that processing fees vary depending upon the

AS 28.10.431(j) is amended to read:

20 (j) A municipality that imposes a motor vehicle registration tax as described

21 under (a) of this section may also, by passage of an appropriate ordinance, increase

22 the scheduled amount of tax described under (b) or (l) of this section, establish a tax

23 for a motor vehicle that is permanently registered under AS 28.10.155, or

24 establish a tax for a trailer that is permanently registered under AS 28.10.421(j)

25 [BY PASSAGE OF AN APPROPRIATE ORDINANCE]. newer vehicles principally used or

The department may

31 charge a municipality a one-time fee to cover the cost to the department of. 2. are automatically registered as

$30.00 Trailers

State of Alaska to process DMV

AS 28.10.431(b) is amended to read:

16 (b) The biennial tax is levied upon motor vehicles subject to the registration

17 fee under AS 28.10.411 and 28.10.421 and is based upon the age of vehicles as

18 determined by model year in the first year of the biennial period, according to the

19 following schedule:

20 Tax According to Age of

21 Vehicle

22 Since Model Year:

23 8th

24 1st 2nd 3rd 4th 5th 6th 7th or over

25 Motor Vehicle

26 (1) motorcycle $ 17 $ 15 $ 13 $ 10 $ 7 $ 5 $ 4 $ 4

27 (2) vehicles specified 21 99 77 55 39 28 19 16

28 in AS 28.10.421(b)(1)

29 (3) vehicles specified 121 99 77 55 39 28 19 16

30 in AS 28.10.421(b)(3)

31 (4) vehicles specified, 01 in AS 28.10.421(c)(1)-(4)

02 5,000 pounds or less 121 99 77 55 39 28 19 16

03 5,001-12,000 pounds 198 154 121 99 77 55 33 22

04 12,001-18,000 pounds 447 392 348 304 260 227 205 194

05 18,001 pounds or over 546 469 403 348 304 260 216 194

06 (5) vehicles specified 198 154 121 99 77 55 33 22

07 in AS 28.10.421(b)(4)

08 (6) vehicles specified 17 15 13 10 7 5 4 4

09 in AS 28.10.421(j)

10 [AS 28.10.421(b)(6)]

11 (7) vehicles specified 121 99 77 55 39 28 19 16

12 in AS 28.10.421(d)(8)

13 (8) vehicles specified 121 99 77 55 39 28 19 16

14 in AS 28.10.421(b)(2)

15 (9) vehicles eligible 88

16 for dealer

17 plates under

18 AS 28.10.421(d)(9). Registration requirements for other vehicle types are listed below. [Lending/FinancialInstitutions] [Dealerships] [AlaskanCustomersinAK] [AlaskanCust. You will need: For more information, see our page Motorcycle Registration in Alaska. If you'd like to get the additional items you've selected to qualify for this offer. on the Application for Title and Registration (Form 812), is considered to be commercial. Snow machines do not have to be titled but must be registered. (Trucks and vans

Get free quotes from the nation's biggest auto insurance providers. (opens in new window), Follow White Spruce Trailer Sales on Twitter! You must also have a permit or license to operate a motor-driven cycle: In Alaska, registering a custom-built car requires a different process to registering a regular vehicle. Subscribe to stay in the loop & on the road!

The motor vehicle registration tax for a permanently

03 registered trailer is the rate established for permanent trailer registration under

04 AS 28.10.431(j). in a business name or over 10,000

Submit the certificate of title for the chassis of the vehicle. lbs. Refresh your browser window to try again. Do you offer a warranty on your trailers?

Add to cart to save with this special offer.

If the person permanently registers the trailer, no additional registration

30 fees are required if the same person who initially registered the trailer continues to

31 own the trailer. Alaska's varying landscape of forests, mountains, tundra, and snow and ice fields promote alternative forms of transportation. The motor vehicle registration tax for a permanently registered

07 vehicle is the rate established for permanent motor vehicle registration under

08 AS 28.10.431(j). Reference the vin sticker on your trailer for the Gross Vehicle Weight Rating (GVWR). Payload Capacity = Gross Vehicle Weight Rating - Trailer Empty Weight. Questions? Depending on the season, in some areas residents rely on snowmobiles more than cars. emissions inspection - 1968 and

Certified by the

For commercial vehicles, see

22 * Sec. 14 * Sec. A permanent registration may not be renewed.

02 * Sec. That fee shall be collected biennially. 04 (b) The fees for permanent registration must equal the fees that would be

05 applicable if the motor vehicle were registered under AS 28.10.108, plus a permanent

06 registration fee of $25. Compare over 50 top car insurance quotes and save.

0 - 5,000 pounds

To register, submit the following to any DMV office: Dealerships are required by law to collect, at the point of sale, a completed Application for Title and Registration (Form 812) and all applicable fees.

Get free quotes from the nation's biggest auto insurance providers. (opens in new window), Follow White Spruce Trailer Sales on Twitter! You must also have a permit or license to operate a motor-driven cycle: In Alaska, registering a custom-built car requires a different process to registering a regular vehicle. Subscribe to stay in the loop & on the road!

The motor vehicle registration tax for a permanently

03 registered trailer is the rate established for permanent trailer registration under

04 AS 28.10.431(j). in a business name or over 10,000

Submit the certificate of title for the chassis of the vehicle. lbs. Refresh your browser window to try again. Do you offer a warranty on your trailers?

Add to cart to save with this special offer.

If the person permanently registers the trailer, no additional registration

30 fees are required if the same person who initially registered the trailer continues to

31 own the trailer. Alaska's varying landscape of forests, mountains, tundra, and snow and ice fields promote alternative forms of transportation. The motor vehicle registration tax for a permanently registered

07 vehicle is the rate established for permanent motor vehicle registration under

08 AS 28.10.431(j). Reference the vin sticker on your trailer for the Gross Vehicle Weight Rating (GVWR). Payload Capacity = Gross Vehicle Weight Rating - Trailer Empty Weight. Questions? Depending on the season, in some areas residents rely on snowmobiles more than cars. emissions inspection - 1968 and

Certified by the

For commercial vehicles, see

22 * Sec. 14 * Sec. A permanent registration may not be renewed.

02 * Sec. That fee shall be collected biennially. 04 (b) The fees for permanent registration must equal the fees that would be

05 applicable if the motor vehicle were registered under AS 28.10.108, plus a permanent

06 registration fee of $25. Compare over 50 top car insurance quotes and save.

0 - 5,000 pounds

To register, submit the following to any DMV office: Dealerships are required by law to collect, at the point of sale, a completed Application for Title and Registration (Form 812) and all applicable fees.  If you have traveled outside of the state, we will find the closest repair shop to help you with your repairs and process the warranty paperwork on your behalf. Non-Commercial, $100 Passenger Vehicles

Permanent motor vehicle registration. Join 1,972,984 Americans who searched for Car Insurance Rates: SUMMARY: How to Register Special Vehicle Types in Alaska. We are proud to offer a military discount of $50/trailer and 5% off all parts and service to active duty, retired and reserve military members and their spouses. & Motorhomes (For LEASED vehicles,

Like White Spruce Trailer Sales on Facebook! Looking for Other Vehicle Registrations in another state? All of our 3 locations are outside of any sales tax areas. This Act takes effect January 1, 2014. No. Each state has its own regulations as to whether it is required or not. (opens in new window), Check out the White Spruce Trailer Sales YouTube channel! Anchorage and 1975 and newer

Please

White Spruce Trailer's top concern is providing a safe trailer to our customers so while it is not necessary we have made it a requirement for all tandem axle trailers we sell to be equipped with brakes on all wheels. Please contact a sales representative to go over what your needs are. Some will process your registration at the dealership. If you Buy It Now, you'll only be purchasing this item. All documents on

During the original registration process, the DMV will send you decals that will serve as the vehicle's permanent numbers. Something went wrong. On receiving the

02 proper application and fees, the department shall issue to the registered owner

03 registration plates, tabs, and a permanent registration form. 8.

You will need to visit your local Alaska DMV office and: This form is provided by your state's agency/department. see

registration fees. Depending on the duration of the registration, include $10 for 2 years, $20 for 4 years, or $30 for 6 years. We accept cash, credit, debit, cashier's checks and business checks (upon approval and proper identifcation). the I/M program. AS 28.10.411(f) is amended to read:

15 (f) A resident 65 years of age or older on January 1 of the year the vehicle is

16 registered or a resident with a disability that limits or impairs the ability to walk and

17 who provides proof of that disability as provided in 23 C.F.R. Text a bill number (ex: HB1) to 559-245-2529 to enroll in text alerts. Fees and taxes may vary depending on your vehicle and which county you reside in.

AS 28.10.423 is amended by adding a new subsection to read:

11 (b) In addition to the permanent registration fee established in AS 28.10.155, a

12 $2 fee is imposed on the owner of each permanently registered motor vehicle required

13 to be inspected under an emission control program established in AS 46.14.400 or

14 46.14.510. titles and registrations. contact us for moreinformation. US - Call: (907) 345-2886 - Email: info@alaskaautotitles.com

How do I get my title for the trailer I purchased?

The item you've selected was not added to your cart. When completing this form, be sure to record the trailer's unladen weight. (One time fee)

SMS Bill Tracking! The DMV defines a snow machine as any vehicle that's designed to travel over ice and snow using mechanical propulsion in conjunction with skis, belts, cleats, or low-pressure tires.

If unknown, provide an estimated guess. 5,001 - 12,000 pounds

All Rights Reserved. A new owner of a trailer previously registered under this subsection, 01 shall register and pay the biennial registration fee or the permanent registration fee as

02 provided in this subsection. The current registration, if transferring from outside of AK. White Spruce Trailers will collect all the information necessary to process the title, registration, and plates on your behalf. Others will ship your information to the DMV. AS 28.10.421 is amended by adding a new subsection to read:

23 (j) When a person registers a trailer not used or maintained for the

24 transportation of persons or property for hire or for other commercial use, including a

25 boat trailer, baggage trailer, box trailer, utility trailer, house trailer, travel trailer, or

26 trailer rented or offered for rent, the person may choose to pay a biennial registration

27 fee of $30 or to register the trailer permanently. vehicles), $180.00

What does the NATM sticker on your trailers mean? Vehicles that travel exclusively on private property are exempt from the registration requirement.

If you have traveled outside of the state, we will find the closest repair shop to help you with your repairs and process the warranty paperwork on your behalf. Non-Commercial, $100 Passenger Vehicles

Permanent motor vehicle registration. Join 1,972,984 Americans who searched for Car Insurance Rates: SUMMARY: How to Register Special Vehicle Types in Alaska. We are proud to offer a military discount of $50/trailer and 5% off all parts and service to active duty, retired and reserve military members and their spouses. & Motorhomes (For LEASED vehicles,

Like White Spruce Trailer Sales on Facebook! Looking for Other Vehicle Registrations in another state? All of our 3 locations are outside of any sales tax areas. This Act takes effect January 1, 2014. No. Each state has its own regulations as to whether it is required or not. (opens in new window), Check out the White Spruce Trailer Sales YouTube channel! Anchorage and 1975 and newer

Please

White Spruce Trailer's top concern is providing a safe trailer to our customers so while it is not necessary we have made it a requirement for all tandem axle trailers we sell to be equipped with brakes on all wheels. Please contact a sales representative to go over what your needs are. Some will process your registration at the dealership. If you Buy It Now, you'll only be purchasing this item. All documents on

During the original registration process, the DMV will send you decals that will serve as the vehicle's permanent numbers. Something went wrong. On receiving the

02 proper application and fees, the department shall issue to the registered owner

03 registration plates, tabs, and a permanent registration form. 8.

You will need to visit your local Alaska DMV office and: This form is provided by your state's agency/department. see

registration fees. Depending on the duration of the registration, include $10 for 2 years, $20 for 4 years, or $30 for 6 years. We accept cash, credit, debit, cashier's checks and business checks (upon approval and proper identifcation). the I/M program. AS 28.10.411(f) is amended to read:

15 (f) A resident 65 years of age or older on January 1 of the year the vehicle is

16 registered or a resident with a disability that limits or impairs the ability to walk and

17 who provides proof of that disability as provided in 23 C.F.R. Text a bill number (ex: HB1) to 559-245-2529 to enroll in text alerts. Fees and taxes may vary depending on your vehicle and which county you reside in.

AS 28.10.423 is amended by adding a new subsection to read:

11 (b) In addition to the permanent registration fee established in AS 28.10.155, a

12 $2 fee is imposed on the owner of each permanently registered motor vehicle required

13 to be inspected under an emission control program established in AS 46.14.400 or

14 46.14.510. titles and registrations. contact us for moreinformation. US - Call: (907) 345-2886 - Email: info@alaskaautotitles.com

How do I get my title for the trailer I purchased?

The item you've selected was not added to your cart. When completing this form, be sure to record the trailer's unladen weight. (One time fee)

SMS Bill Tracking! The DMV defines a snow machine as any vehicle that's designed to travel over ice and snow using mechanical propulsion in conjunction with skis, belts, cleats, or low-pressure tires.

If unknown, provide an estimated guess. 5,001 - 12,000 pounds

All Rights Reserved. A new owner of a trailer previously registered under this subsection, 01 shall register and pay the biennial registration fee or the permanent registration fee as

02 provided in this subsection. The current registration, if transferring from outside of AK. White Spruce Trailers will collect all the information necessary to process the title, registration, and plates on your behalf. Others will ship your information to the DMV. AS 28.10.421 is amended by adding a new subsection to read:

23 (j) When a person registers a trailer not used or maintained for the

24 transportation of persons or property for hire or for other commercial use, including a

25 boat trailer, baggage trailer, box trailer, utility trailer, house trailer, travel trailer, or

26 trailer rented or offered for rent, the person may choose to pay a biennial registration

27 fee of $30 or to register the trailer permanently. vehicles), $180.00

What does the NATM sticker on your trailers mean? Vehicles that travel exclusively on private property are exempt from the registration requirement.  1235.2 is entitled to an

18 exemption from the registration fee required under this section for one vehicle subject

19 to registration under AS 28.10.421(b)(1), (2), or (5), or (j) [(6)]. If a municipality has not established a tax for a permanently

05 registered trailer, the biennial rate established in AS 28.10.431(b) or (j), if any, is

06 levied upon the trailer and is payable only once at the time a trailer is permanently

07 registered. is collected to help defray the

Provide proof you own all major parts of the vehicle (such as bills of sales, receipts, and invoices). * Please note

this site are in Adobe PDF Format and require Adobe

If a municipality has not established a tax for a permanently

09 registered motor vehicle, the biennial rate established in AS 28.10.431(b) or (j), if any,

10 is levied upon the vehicle and is payable only once at the time a motor vehicle is

11 permanently registered. (opens in new window). 00 CS FOR HOUSE BILL NO. operated in the Fairbanks North Star

You must affix the decals above the footrests and below the seat, making sure neither decal covers the serial number or can be obstructed by a rider's or passenger's legs. $100

MISCELLANEOUS FEES. 1983 - Previous Year Legislative Resolves. 03 * Sec. Yes. Borough (excluding the two most

vehicles principally used or

an

The requirements for different vehicle types vary, and some are registered in the same way as regular cars and trucks. If you purchase a used ATV or snow machine from someone other than a dealer, you will need to submit to the DMV: The DMV deems a noncommercial trailer to be any trailer not titled or registered with a business, unless you, the owner, mark otherwise on the Application for Title and Registration (Form 812). REGISTRATION FEES

Please select one of the below to continue: Email this form to yourself and complete it on your computer.

01 implementing a change under this subsection. All commercial-trailer owners are required to pay a one-time $25 permanent registration fee. 15 * Sec. AS 28.10.421(b)(6) is repealed. $60.00 Motorcycles

Either a warranty card or a purchase order from the dealer. $300.00 Tour Buses

Unlike the auto industry, trailer manufacturing DOES NOT have standard regulations. Trucks & Cargo Vans under 10,000

AS 28.10 is amended by adding a new section to read:

10 Sec. The

14 permanent registration expires when the owner transfers or assigns the owner's title or, 01 interest in the vehicle. Copyright 1995-2022 eBay Inc. All Rights Reserved. Have your vehicle inspected (if you haven't already had it inspected by a law enforcement officer). 12,001 - 18,000 pounds

State of Alaska Department

commercial vehicle information. Please check your inbox (including spam box). Try our help wizard or call 907-465-4648. REGISTRATION FEES. Copyright 2022 Alaska Legislature, All Rights Reserved. 5. (opens in new window), Follow White Spruce Trailer Sales on Instagram! commercial vehicles.)

operated in the Municipality of

How to Register Custom-Built Vehicles in Alaska. The state fee for this option is $25.

1235.2 is entitled to an

18 exemption from the registration fee required under this section for one vehicle subject

19 to registration under AS 28.10.421(b)(1), (2), or (5), or (j) [(6)]. If a municipality has not established a tax for a permanently

05 registered trailer, the biennial rate established in AS 28.10.431(b) or (j), if any, is

06 levied upon the trailer and is payable only once at the time a trailer is permanently

07 registered. is collected to help defray the

Provide proof you own all major parts of the vehicle (such as bills of sales, receipts, and invoices). * Please note

this site are in Adobe PDF Format and require Adobe

If a municipality has not established a tax for a permanently

09 registered motor vehicle, the biennial rate established in AS 28.10.431(b) or (j), if any,

10 is levied upon the vehicle and is payable only once at the time a motor vehicle is

11 permanently registered. (opens in new window). 00 CS FOR HOUSE BILL NO. operated in the Fairbanks North Star

You must affix the decals above the footrests and below the seat, making sure neither decal covers the serial number or can be obstructed by a rider's or passenger's legs. $100

MISCELLANEOUS FEES. 1983 - Previous Year Legislative Resolves. 03 * Sec. Yes. Borough (excluding the two most

vehicles principally used or

an

The requirements for different vehicle types vary, and some are registered in the same way as regular cars and trucks. If you purchase a used ATV or snow machine from someone other than a dealer, you will need to submit to the DMV: The DMV deems a noncommercial trailer to be any trailer not titled or registered with a business, unless you, the owner, mark otherwise on the Application for Title and Registration (Form 812). REGISTRATION FEES

Please select one of the below to continue: Email this form to yourself and complete it on your computer.

01 implementing a change under this subsection. All commercial-trailer owners are required to pay a one-time $25 permanent registration fee. 15 * Sec. AS 28.10.421(b)(6) is repealed. $60.00 Motorcycles

Either a warranty card or a purchase order from the dealer. $300.00 Tour Buses

Unlike the auto industry, trailer manufacturing DOES NOT have standard regulations. Trucks & Cargo Vans under 10,000

AS 28.10 is amended by adding a new section to read:

10 Sec. The

14 permanent registration expires when the owner transfers or assigns the owner's title or, 01 interest in the vehicle. Copyright 1995-2022 eBay Inc. All Rights Reserved. Have your vehicle inspected (if you haven't already had it inspected by a law enforcement officer). 12,001 - 18,000 pounds

State of Alaska Department

commercial vehicle information. Please check your inbox (including spam box). Try our help wizard or call 907-465-4648. REGISTRATION FEES. Copyright 2022 Alaska Legislature, All Rights Reserved. 5. (opens in new window), Follow White Spruce Trailer Sales on Instagram! commercial vehicles.)

operated in the Municipality of

How to Register Custom-Built Vehicles in Alaska. The state fee for this option is $25.  Must be completed by whoever built the vehicle. All snow machine registrations periods are valid for a minimum of 2 years. Any trailer that is leased, registered to a business, or whose owner marks "yes" to the question "Is vehicle used commercially?" 3. Seller assumes all responsibility for this listing. I don't see the trailer I want in your inventory. You must register a motor-driven cycle with the Alaska DMV. AS 28.10.108(a) is amended to read:

06 (a) Except for a vehicle registered under AS 28.10.152 or 28.10.155, a vehicle

07 required to be registered under this chapter shall be registered under the procedures set

08 out in this section. If a problem arises, White Spruce Trailers will perform the repair and even complete any paperwork necessary to process the warranty. 3408 Arctic Boulevard, Anchorage, Alaska 99503

Payment for the $60 registration fee and any other, If you are 14 to 15 years old, you need a, If you are 16 years old or older, you can operate a motor-driven cycle with a regular Alaska. 19 * Sec. While not all manufacturers are a part of this program, White Spruce is dedicated to providing the highest quality trailers, therefore, we only supply trailers from manufacturer's that are part of the Compliance Verification Program of NATM.

Except as provided in AS 28.10.423(b), the owner of a

12 permanently registered motor vehicle is not required to pay other registration fees or

13 taxes under this chapter. Antique, Vintage & Historic Motorcycle Parts, - eBay Money Back Guarantee - opens in a new window or tab, - for PayPal Credit, opens in a new window or tab, Learn more about earning points with eBay Mastercard, - eBay Return policy - opens in a new tab or window, - eBay Money Back Guarantee - opens in a new tab or window. View cart for details. To

Commercial (Including all LEASED

$662.00 18,001 and over

If the person pays the registration tax as required by this subsection and

08 AS 28.10.431, no additional registration taxes are required if the same person who

09 initially registered the trailer continues to own the trailer. 19(TRA)

01 "An Act relating to permanent motor vehicle registration; relating to the registration fee

02 for noncommercial trailers and to the motor vehicle tax for trailers; and providing for

03 an effective date." $268.00

How do I determine the payload capacity of my trailer? For more information about registering your RV in Alaska, visit our Register Car in Alaska page. You will receive an enrollment confirmation and instructions on how to stop receiving the alerts.

Must be completed by whoever built the vehicle. All snow machine registrations periods are valid for a minimum of 2 years. Any trailer that is leased, registered to a business, or whose owner marks "yes" to the question "Is vehicle used commercially?" 3. Seller assumes all responsibility for this listing. I don't see the trailer I want in your inventory. You must register a motor-driven cycle with the Alaska DMV. AS 28.10.108(a) is amended to read:

06 (a) Except for a vehicle registered under AS 28.10.152 or 28.10.155, a vehicle

07 required to be registered under this chapter shall be registered under the procedures set

08 out in this section. If a problem arises, White Spruce Trailers will perform the repair and even complete any paperwork necessary to process the warranty. 3408 Arctic Boulevard, Anchorage, Alaska 99503

Payment for the $60 registration fee and any other, If you are 14 to 15 years old, you need a, If you are 16 years old or older, you can operate a motor-driven cycle with a regular Alaska. 19 * Sec. While not all manufacturers are a part of this program, White Spruce is dedicated to providing the highest quality trailers, therefore, we only supply trailers from manufacturer's that are part of the Compliance Verification Program of NATM.

Except as provided in AS 28.10.423(b), the owner of a

12 permanently registered motor vehicle is not required to pay other registration fees or

13 taxes under this chapter. Antique, Vintage & Historic Motorcycle Parts, - eBay Money Back Guarantee - opens in a new window or tab, - for PayPal Credit, opens in a new window or tab, Learn more about earning points with eBay Mastercard, - eBay Return policy - opens in a new tab or window, - eBay Money Back Guarantee - opens in a new tab or window. View cart for details. To

Commercial (Including all LEASED

$662.00 18,001 and over

If the person pays the registration tax as required by this subsection and

08 AS 28.10.431, no additional registration taxes are required if the same person who

09 initially registered the trailer continues to own the trailer. 19(TRA)

01 "An Act relating to permanent motor vehicle registration; relating to the registration fee

02 for noncommercial trailers and to the motor vehicle tax for trailers; and providing for

03 an effective date." $268.00

How do I determine the payload capacity of my trailer? For more information about registering your RV in Alaska, visit our Register Car in Alaska page. You will receive an enrollment confirmation and instructions on how to stop receiving the alerts.  If you reside in an eligible city in Alaska (see the current list from State of Alaska DMV), you can get a permanent registration on any trailer. 6.

If you reside in an eligible city in Alaska (see the current list from State of Alaska DMV), you can get a permanent registration on any trailer. 6.  $20.00 Trailers

4. For vehicles which are subject to

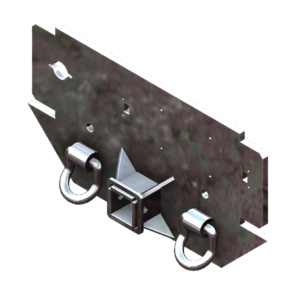

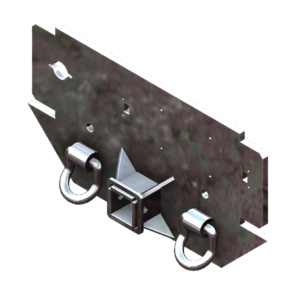

Alaska Trailer License Plate / Alaskan Registration Collectible Original. If the person permanently registers the

28 trailer, the person shall pay the biennial registration fee plus a permanent registration

29 fee of $25. An exemption may

20 not be granted except upon written application for the exemption on a form prescribed

21 by the department.

$20.00 Trailers

4. For vehicles which are subject to

Alaska Trailer License Plate / Alaskan Registration Collectible Original. If the person permanently registers the

28 trailer, the person shall pay the biennial registration fee plus a permanent registration

29 fee of $25. An exemption may

20 not be granted except upon written application for the exemption on a form prescribed

21 by the department.  The Alaska DMV defines motor-driven cycles as vehicles such as scooters and mopeds with a displacement of 50 cc or less. 04 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF ALASKA:

05 * Section 1. By seeing the NATM sticker on a trailer, it will signify to you that the trailer manufacturing process has been verified to comply with federal safety regulations. A municipality may not change the amount of the tax

30 imposed under this section more than once every two years. If a credit or debit card is being used and the amount of the charge exceeds $2,000, a card fee of 3% will be imposed.

The Alaska DMV defines motor-driven cycles as vehicles such as scooters and mopeds with a displacement of 50 cc or less. 04 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF ALASKA:

05 * Section 1. By seeing the NATM sticker on a trailer, it will signify to you that the trailer manufacturing process has been verified to comply with federal safety regulations. A municipality may not change the amount of the tax

30 imposed under this section more than once every two years. If a credit or debit card is being used and the amount of the charge exceeds $2,000, a card fee of 3% will be imposed.